The Black–Scholes Equation

Application ID: 82

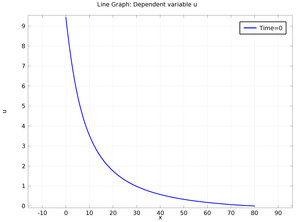

The Black-Scholes equation, computes the value u of a European stock option. Black-Scholes derived an analytical expression for the solution to this problem. However, the formula works only for certain cases; for instance, you cannot employ it when sigma and r are functions of x and t. Here, sigma denotes the volatility, r the continuous compounding rate of interest, and x the underlying asset price.

Using a PDE formulation allows you to determine the price for such cases. This model sets up the PDE formulation of the Black Scholes equation and in addition, this model also shows how to solve the 1D time-dependent variation using a 2D geometry with the y-coordinate corresponding to time.

This model example illustrates applications of this type that would nominally be built using the following products:

however, additional products may be required to completely define and model it. Furthermore, this example may also be defined and modeled using components from the following product combinations:

The combination of COMSOL® products required to model your application depends on several factors and may include boundary conditions, material properties, physics interfaces, and part libraries. Particular functionality may be common to several products. To determine the right combination of products for your modeling needs, review the Specification Chart and make use of a free evaluation license. The COMSOL Sales and Support teams are available for answering any questions you may have regarding this.